What is Pay As You Go(Payg or Paygo) Solar?

A creative way of selling solar energy is gaining traction in sub-Saharan Africa: customers can pay as they go.

Only one in six rural inhabitants in sub-Saharan Africa has access to electricity. For households living off the grid, kerosene lamps are the primary lighting source—an expensive technology that is also unsafe, because kerosene is flammable as well as poisonous when inhaled or ingested. The World Bank estimates that breathing kerosene fumes is the equivalent of smoking two packs of cigarettes a day, and two thirds of adult females with lung cancer in developing nations are nonsmokers. “The poorest people in the world are not just paying a bit more for their energy, they’re paying a disproportionate amount”, says Simon Bransfield-Garth, CEO of Azuri Technologies, a solar services firm based in Cambridge, England.

Across the U.S. and U.K. electricity from a utility costs between 10 to 15 cents per kilowatt-hour (kWh). A villager in rural Kenya or Rwanda, however, pays an equivalent cost of $8 per kWh for kerosene lighting. Often 30 percent or more a family’s income is spent on kerosene. Charging a mobile phone is even more expensive. That same villager would pay nearly 400 times more to charge a mobile phone in rural Kenya than in the U.S. Solar-powered charger kits are a promising alternative, but many rural families cannot afford the up-front cost of these systems, which start at $50.

With a Pay-As-You-Go model (PAYG) for solar kits, on the other hand, customers can instead pay an up-front fee of around $10 for a solar charger kit that includes a two- to five-watt solar panel and a control unit that powers LED lights and charges devices like mobile phones. Then they pay for energy when they need it—frequently in advance each week—or when they can (say, after a successful harvest). In practice, kits are paid off after about 18 months and subsequent electricity is free to the new owner. PAYG customers are finding that instead of paying $2 to $3 a week for kerosene, they pay less than half that for solar energy. The PAYG concept is a familiar one for hundreds of millions of Africans who purchase mobile phone minutes and kerosene fuel incrementally.

Azuri is one of a number of start-ups selling solar energy to off-grid customers in installments. Their customers buy scratch-off cards containing a code that they send to the company via an SMS message. The customer then receives an unlock code that they enter into their solar kit.

Another company, Angaza Design of San Francisco, has integrated an analog modem into their solar charger that “talks” with the customer’s mobile phone to authenticate a transaction. M-KOPA—a spin-off of the widespread and successful M-PESA mobile payment network—leverages its existing mobile network to receive payments. Payment plans start at less than 50 cents a day and customers can add funds to their account at their convenience.

So far, PAYG has shown notable levels of success. Azuri counts over 21,000 customers in 10 countries (Kenya, Uganda, Tanzania, Ethiopia, Rwanda, Sierra Leone, Ghana, South Africa, Zimbabwe and South Sudan). M-KOPA already has 30,000 customers and is looking to attract a large portion of the 15 million active M-PESA users spread throughout the continent. Angaza is on track to reach 10,000 customers in the next nine to 12 months. Bryan Silverthorn, the firm’s chief technology officer, says the feedback has been “aspirational.” In their experience, solar kits are empowering off-grid Africans—literally giving them the power to dramatically improve their quality of life.

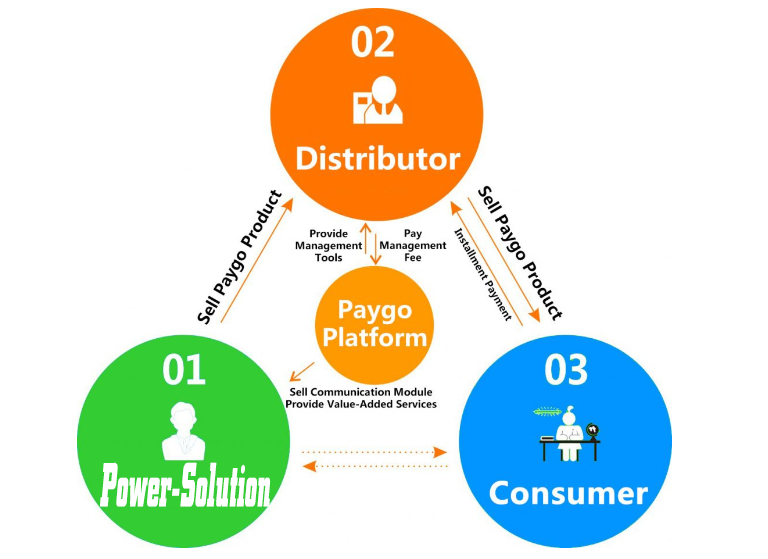

Companies report that the PAYG business model replicates well from country to country. They reach rural communities by working with local distribution partners within each country, who also make money from each solar kit sale. Adoption of solar chargers typically spreads quickly via word-of-mouth advertising. Once one family has had success with a PAYG solar system, other families often purchase one as well.

Yet challenges remain. Many PAYG start-ups are running into limits of working capital; companies front the initial cost of these solar kits and are not fully reimbursed for 18 months. This leads to cash flow constraints that intensify when customers default. “The financial models don’t yet exist to provide debt capital, and companies can only fund operations out of their equity for so long. So there is a need for debt instruments to enable this to be funded at scale”, Bransfield-Garth says.

Still, the PAYG model may offer important lessons for the developed world as the installed solar base grows. Says Silverthorn: “There are all these debates about when solar will reach grid parity in the United States and elsewhere. Africa is a place where, for a huge swath of the population, solar energy is now the cheapest option. No one knows what will happen next.”